“HONOR Your Heart” is HONOR Philippines Valentine’s Campaign promoting Heart Health (more…)

PetPal launches PH’s first all-in-one pet care super app

In yet another industry-first, 917Ventures‘ PetPal, a front-runner in pet care in Southeast Asia, has unveiled their all-in-one pet care super app. The platform serves as a mobile version of their comprehensive pet care solution. (more…)

Possibilities for PWA in health-tech

Are you ready to explore the amazing potential of progressive web apps (PWA) in health-tech? Join us for a live and interactive session with Abdul Paravengal, the managing director at Pulse 63 Healthcare Ventures, on Thursday, March 16th at 7:00 PM. He will share his insights into how PWA can accelerate access and quality across healthcare in the Philippines and beyond. You don’t want to miss this opportunity to learn from an expert and network with other PWA enthusiasts.

app.pwapilipinas.org/event/eLqEXLdZCIrGp3wWsf4p

Shopee teams up with the Department of Health to push Booster Vaccination

MANILA, PHILIPPINES, SEPTEMBER 23, 2022 – In line with its continuous commitment to help every Filipino increase their protection against COVID-19, Shopee has partnered with the Department of Health (DOH) for the Bakunahang Bayan: PinasLakas Special Vaccination Days campaign from September 26-30, to facilitate the rapid mobilization of COVID-19 vaccination among all eligible populations. (more…)

Globe Group and Mexico’s Salud Interactiva uplift PH healthcare through digital solutions

It has been seven years since leading Philippine digital solutions platform Globe formed a joint venture with Mexican company Salud Interactiva for an all-day health service hotline. Today, the two industry leaders continue to make healthcare more accessible to the public through improved digital solutions that can be easily accessed via mobile phones. (more…)

KonsultaMD Group seen to help government delivery of primary care

The consolidation of KonsultaMD, HealthNow and AIDE – three of the country’s market-leading digital health apps – is expected to help the government lead the country’s development of a productive, resilient, equitable and people-centered health system.

This follows the integration of the three applications into one KonsultaMD super app, bringing together KonsultaMD’s expertise in on-demand consultations, HealthNow’s strength in medicine delivery, and AIDE’s mastery of providing health services in the home

KonsultaMD provides foodpanda delivery partners and family members with FREE healthcare

Leading telehealth service platform KonsultaMD and quick-commerce platform foodpanda Philippines have collaborated to provide riders, bikers and other delivery partners and their family members free healthcare for one month. (more…)

Oil price hikes wrecking your budget? Globe Group has services to help you #SaveOnFuel

Just as we are slowly trying to put the COVID-19 pandemic behind us, the Russia-Ukraine conflict came into play and disrupted global markets once again, causing a steep rise in the prices of oil and other commodities. Despite these challenges, we long to move forward and do the things we love.

The Globe Group is, fortunately, a step ahead and is ready with a variety of platforms, solutions, and promos that will continue to enable Filipinos’ everyday experiences while creating utmost value for customers. (more…)

Gigacover continues robust growth in the Philippines with new client contracts, expands local headcount and solution portfolio to power further expansion and better support for the country’s gig workforce

- Since its market entry in December 2021, Gigacover has nearly doubled its growth in country, boosted by increases in headcount, users, customer portfolio, and revenue

- Gigacover continues strong growth in the Philippines with logistics platform Gogo Xpress powered by QuadX, delivery platforms Pick-A-Roo and When In Baguio to power their rider and shopper benefits and social media platform Partipost to power their employees and provide staff benefits

- Gigacover launched Employee Benefits in January 2022 to provide comprehensive coverage for full-time employees at an affordable cost, which aims to provide inclusive worker benefits beyond the gig economy

- Gigacover will continue its push to cover 100,000 informal workers in the Philippines by the end of 2022, and aim to expand to more industries to continue to provide inclusive worker benefits and co-create new products specifically tailored to different business needs

Philippines, 3 March 2022 – Gigacover, Southeast Asia’s financial health platform, today announced its 100-day milestone and robust growth in the Philippines. Since Gigacover’s market entry into the Philippines in December 2021, the team has registered overall growth of 180 per cent, expanding its focus into additional industries such as business process outsourcing and manpower. Gigacover has also doubled its local headcount to better support their growing presence.

Gigacover has grown its customer base and revenue by more than 100 per cent, driven by the closing of new clients as well as the launch of new products. Along with Earning Protection Insurance, Gigacover has launched Employee Benefits in January 2022 to provide comprehensive coverage for full-time employees at an affordable cost, aiming to provide inclusive worker benefits beyond the gig economy. This has translated to an increase in the users of Gigacover’s products by nearly 10 per cent.

Earnings Protection Insurance has emerged as one of the most popular products in the Philippines for Gigacover. As the first of its kind in the region, Earnings Protection Insurance provides informal workers access to paid medical and sick leaves – a benefit that is typically associated with regularised employees. Expanding into serving salaried workers, Gigacover’s Employee Benefits is a comprehensive and competitively priced product to cover full-time employees. Participating organisations would be able to provide comprehensive benefits for its employees such as Inpatient and Outpatient services, Hospital Room and Board, Annual Physical Examinations (APE), Comprehensive Wellness Program, as well as Emergency and Preventive Care Benefits. Leveraging the Philippines e-Commerce boom, Gigacover has also introduced Parcel Insurance to provide affordable coverage for different categories of parcels with a highly efficient claims process.

In addition to Gogo Xpress powered by QuadX, who has recently renewed its partnership with Gigacover for the coming year, Partipost has also come on board in January 2022 with the aim of providing employee benefits for its full-time staff. Delivery platforms Pick-A-Roo and When In Baguio among others that have most recently been added to Gigacover’s client portfolio in February 2022, extending enhanced coverage and protection for their gig workers and employees.

“We are grateful for the trust that our clients and partners have placed in us, an essential factor behind our success. Our growth momentum reaffirms the value that Gigacover can bring to the Philippines’ gig economy with our strategy of offering right-sized products. This has provided the basis for the innovation of our new offerings, tailored to the unique needs of the local markets,” said Sebastian Raphael San, Country Manager of Gigacover Philippines and Singapore.

In comparison to the independent workforce in broader Southeast Asia, Gigacover has observed increased priorities being placed by the Philippines’ gig economy in areas such as personal accidents and income protection. These are often deciding factors influencing gig workers’ decisions to work for a certain matching platform. Gig workers are also focusing on having access to a level of security that their regular salaried counterparts typically enjoy exclusively. Moving into 2022, Gigacover aims to launch Motor Excess Reduction into the Philippines by Q2 2022, reducing the financial liability in the event of accidents which will be especially useful for professions such as delivery riders that spend most of their working day on the road.

“We’ve successfully processed our first Earnings Protection (Outpatient Benefit) claim, enabling a rider from Gogo Xpress to recover his lost income for his leave of absence while on bed rest. We hope that these improved benefits will continue to help our clients attract and engage with their employees, and will be instrumental in advancing our objective of empowering underserved segments of the local workforce with enhanced coverage and financial stability for inclusive growth,” added Sebastian.

In the near term, Gigacover’s immediate priorities are to continue growing its customer base by as much as 90 per cent, and further optimising its claims experiences so that users can look forward to receiving their payouts faster. It will also continue its push to cover 100,000 informal workers in the Philippines by the end of 2022. Gigacover will also look to expand to more industries, such as construction, to continue to provide inclusive worker benefits and co-create new products specifically tailored to different business needs.

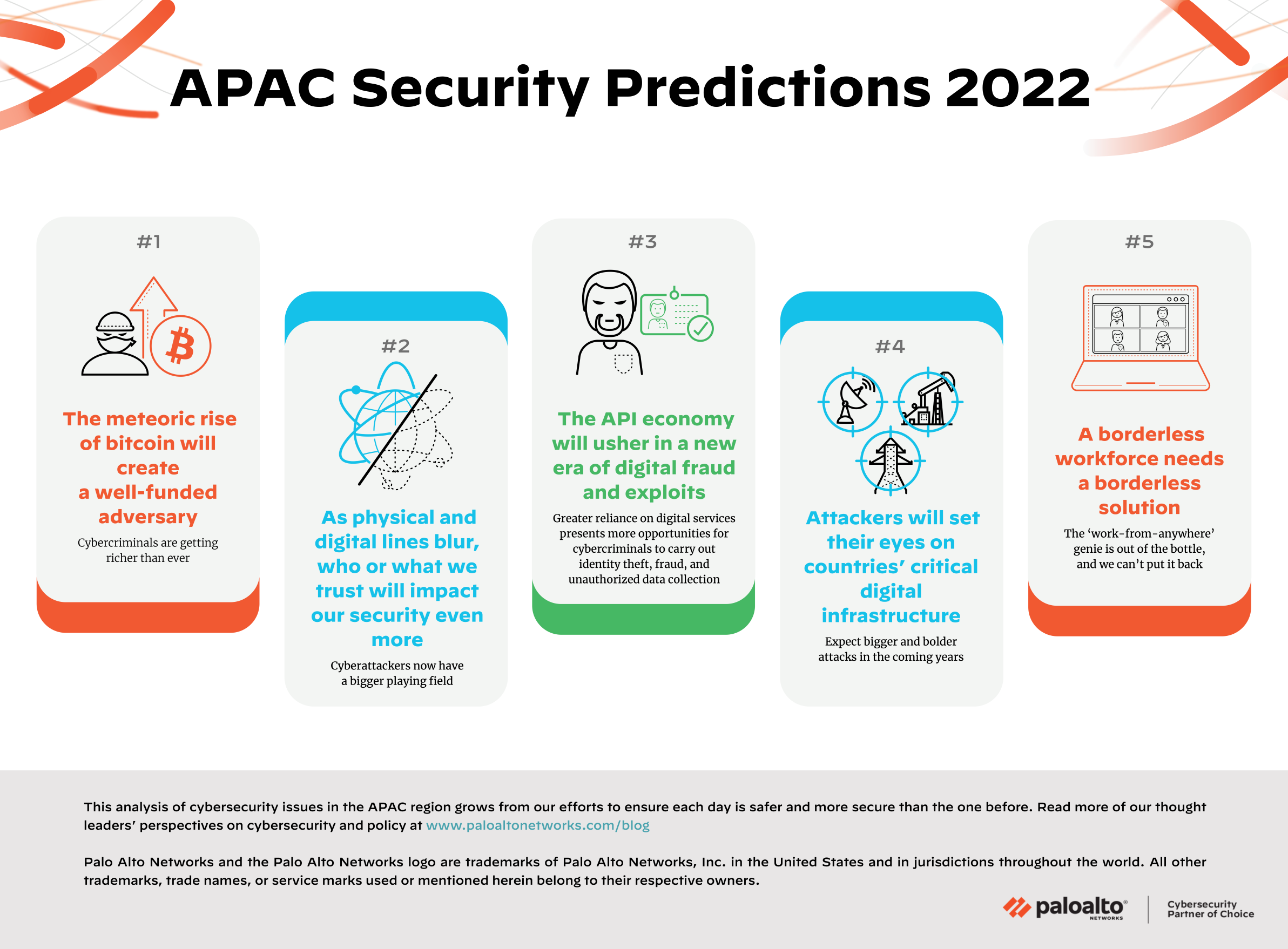

Palo Alto Networks APAC cybersecurity predictions 2022

Philippines – December 16, 2021 – Palo Alto Networks (NASDAQ: PANW), the global cybersecurity leader, released its predictions for the cybersecurity trends that will shape the digital landscape for the year ahead. (more…)

![[L-R] Present at the MOU signing were Ms. Josephine M. Guillermo-Lopez, Deputy Executive Director – Hospital Support Services, Philippine Heart Center; Dr. Joel M. Abanilla, Executive Director, Philippine Heart Center; Stephen Cheng, Vice President of HONOR Philippines; and Erwin Ng, Owner of Jump Manila.](https://mljltdframzu.i.optimole.com/cb:yCHW.5813e/w:1917/h:1080/q:mauto/ig:avif/f:best/https://phil-it.org.ph/wp-content/uploads/2024/02/L-R-Present-at-the-MOU-signing-were-Ms.-Josephine-M.-Guillermo-Lopez-Deputy-Executive-Director-–-Hospital-Support-Services-scaled.jpg)