Brands can now flip a switch to break the cycle of artificial intelligence-powered social engineering attacks in Android and iOS apps and protect billions of mobile users from fraud and abuse in real time. (more…)

Global mobile app survey: Consumers want better fraud protections and app maker accountability to ensure safe experiences

1 in 4 consumers say that they themselves or a friend or relative has been the victim of mobile app cyber attack (more…)

GCash rolls out ‘DoubleSafe’ to arrest account takeovers

Intensifies information campaign vs scams through GSafeTayo (more…)

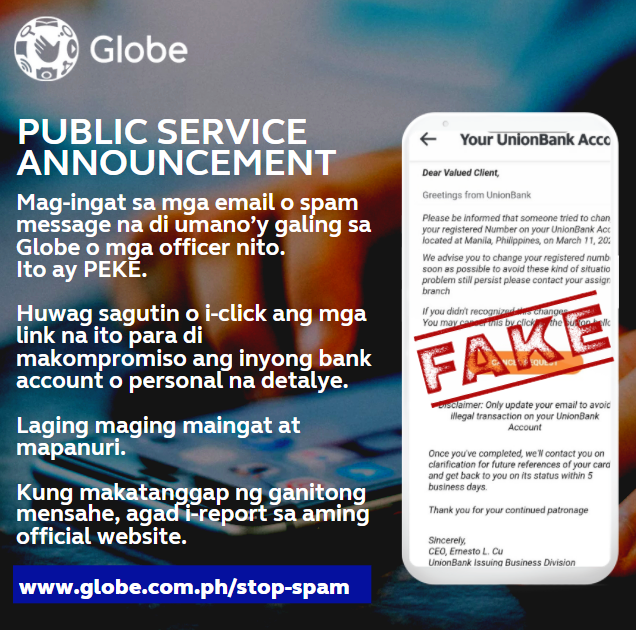

Globe warns customers against new phishing threats, blocks 203 sites in Q1 2022

Globe blocks over 140,000 smishing messages in Feb-March

In 2021, 57% of all cybercrimes were scams — Digital Risk Summit

Social media is the major channel for scammers in APAC (more…)

SSS asks members, employers to keep online login details to themselves

Social Security System (SSS) President and CEO Michael G. Regino today urged members, pensioners, and employers of the state-pension fund to secure their login credentials on the My.SSS portal and other personal information to protect their accounts from fraudulent transactions. (more…)

Globe warns public vs phishing attacks amid Russia-Ukraine conflict

Globe advises customers to protect their data to avoid being victimized by fraudsters

Amid challenging times, the incidence of getting easy money even through illegal means becomes attractive. Globe issues this warning for customers to stay vigilant and raise awareness on how to protect one’s data to prevent being victims of fraud.

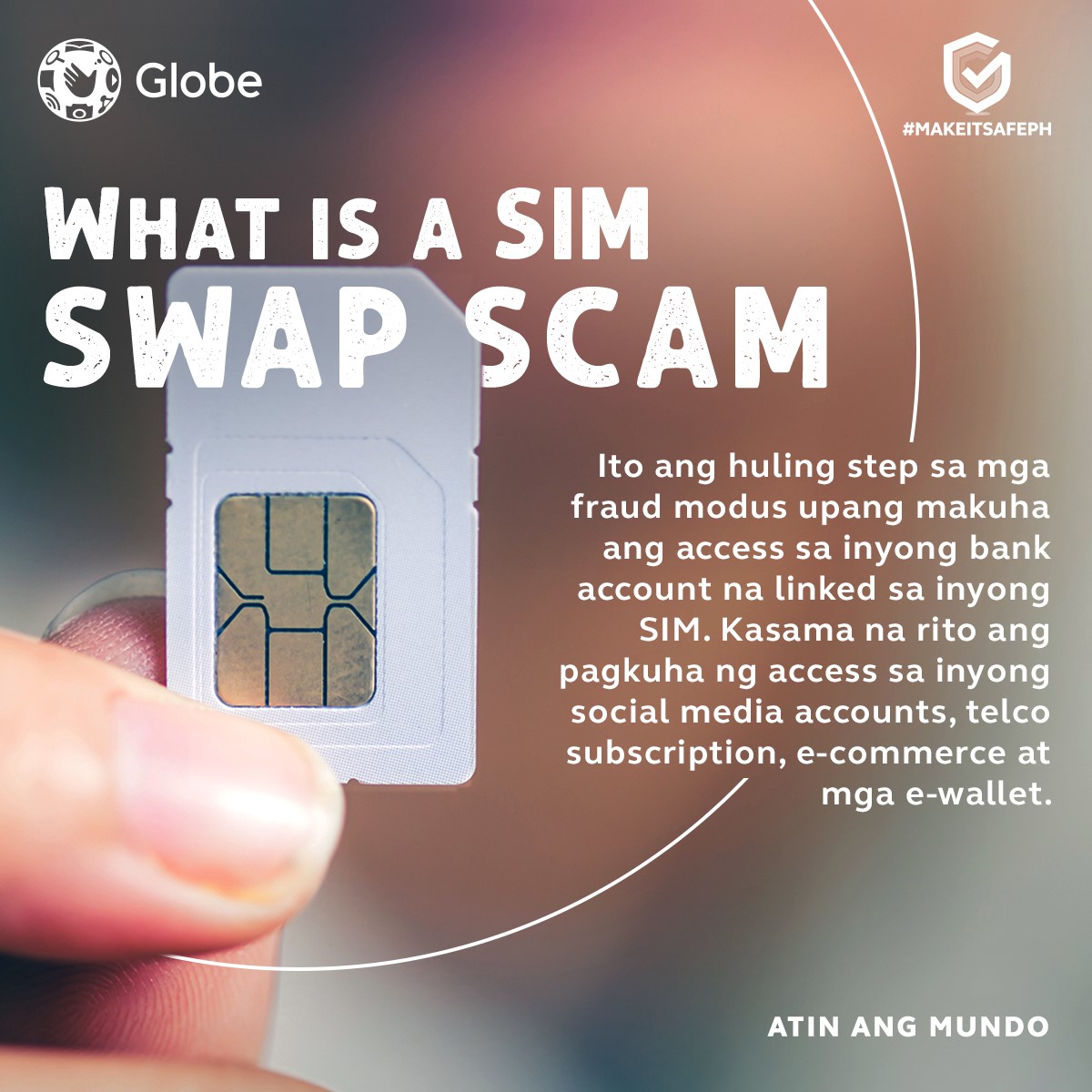

A modus called “SIM swap scam” is the last step carried out by scammers, in order to take over an individual’s financial accounts — bank account details, trading information, e-wallet and/or credit cards.

This modus often involves a victim who’s been long targeted for the scam. The fraudster has invested time to gather bank account details, email addresses, online credentials, personal facts and identification together with the mobile number registered with the bank for sending a one-time password (OTP). The last leg will be to take over the SIM of the mobile number registered for the OTP sending. (more…)