1 February 2023, Manila, Philippines — Pouch, the first lightning service provider in the Philippines, has partnered with Strike, the world’s leading digital payments platform built on Bitcoin’s Lightning Network, to facilitate fast, secure, and low-cost remittance payments from the U.S. to the Philippines.

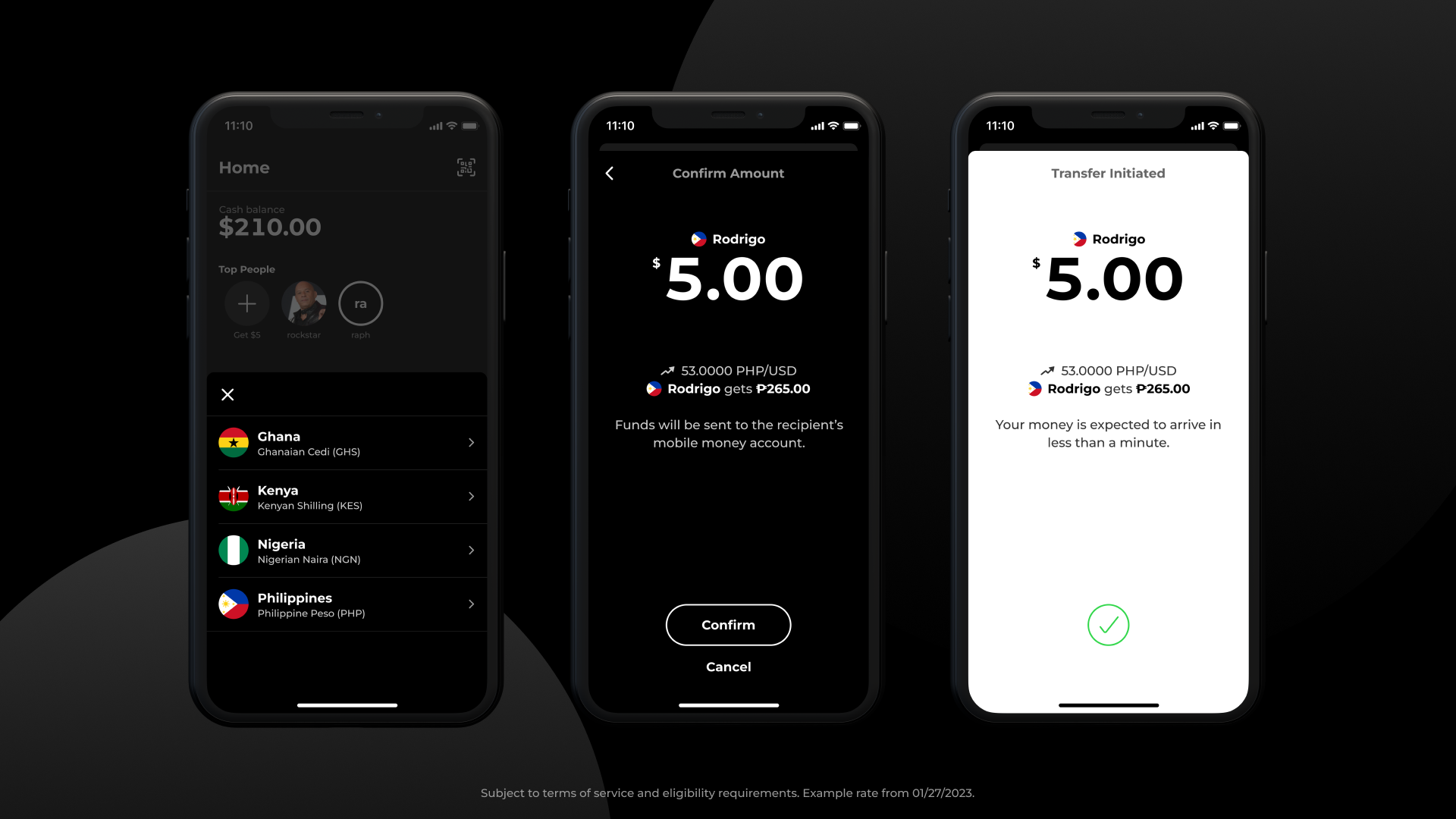

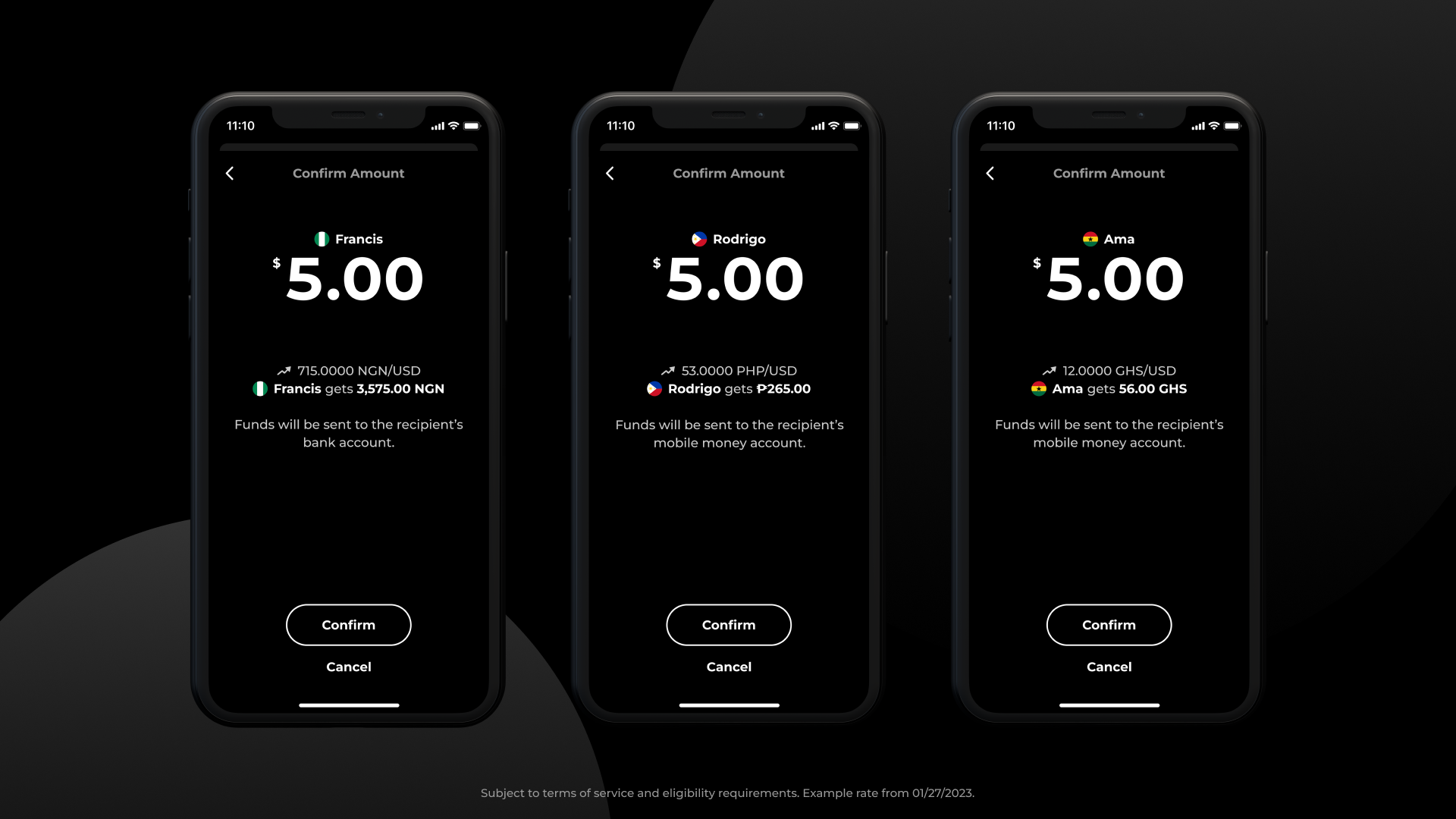

Pouch has partnered with Strike to make digital payments faster, cheaper, and more accessible for people globally. Customers, including Filipino expats in the U.S., can now send U.S. dollars to the Philippines and have the funds received as Philippine pesos in a recipient’s bank or mobile money account.

Pouch was founded in August 2021 by Chief Executive Officer (CEO) Ethan Rose, who left his software engineering job in the U.S. to focus on his passion — improving the experience of sending money back home to the Philippines.

With its customer-centric approach to cross-border remittance services, Pouch was able to quickly grow its presence in the country. In 2022, Pouch spearheaded the massive adoption of bitcoin and the use of the lightning wallet in Boracay, turning the summer destination into a Bitcoin Island.

According to the World Bank, the Philippines is one of the top five global remittance markets in the world. Remittance inflows from overseas Filipino workers (OFWs) posted a 5.7 percent year-on-year growth to USD2.64 billion in November 2022.

Many Filipino families rely on remittances to cover their household expenses, such as food, utility bills, education, and debt payments. However, transfer fees take a huge portion of those funds. The average transaction cost of sending remittances to the Philippines is 4.57% based on data from the World Bank.

One of the World Bank’s Sustainable Development Goals aims to reduce money transfer costs to 3% of total transaction value by 2030. Pouch seeks to realize this ambition by providing faster and more convenient payments across borders at the best possible exchange rates.

“The U.S. to Philippines remittance market is one of the largest in the world, and until now, most Filipino-Americans have been limited to outdated options,” said Ethan Rose.

“With Pouch’s partnership with Strike, we are revolutionizing the way cross-border payments are made, empowering people to easily send money to their loved ones back home. We are proud to be a part of building the world’s most powerful payment network for global transactions,” he added.

“Remittances are a broken system and Strike delivers an incredibly empowering experience for people to send money around the world in nearly an instant,” said Jack Mallers, Founder and CEO of Strike. “We’re excited to partner with Pouch to advance financial inclusion and bring fast, low-cost cross-border payments via the Lightning Network to the Philippines. Our technology allows us to both improve on the existing cross-border experience and include those that have previously been excluded by legacy payment rails.”